Initial prices are the prices at which the house goes on sale.

When setting the initial price level for apartments, the developer needs to solve two main issues:

Answering the first question, it should be noted that among developers, there are two most common approaches to setting starting prices:

The market-oriented approach is the most common, as it is applied to objects of wide demand in the low and medium price ranges. To calculate the average initial price based on competitors’ prices, the developer needs to perform quite complex calculations and compare the characteristics of similar objects with his own. Developers can do this manually by collecting information about competitors’ features (values) and prices or using automated valuation systems (Automated Valuation Models).

For a qualitative assessment, you need to have a sufficient number of analogs – preferably dozens of projects at different stages but with similar location characteristics. Often, there is no such number of analogs, so the assessment is carried out based on 2-3 projects. At the same time, the possible error of calculations may exceed the result itself. It is about the disadvantages of this approach.

A clear advantage of such an approach is the effort to establish a competitive ratio of price and values, which corresponds to a rational approach to a potential client’s choice of an apartment. However, every sales manager can say that choosing an apartment has a more pronounced emotional component than a rational one.

The cost and desired rate of return approach are less commonly used. The main category of objects belongs to the high price range. As a rule, such projects are distinguished by a unique location, aesthetics, design, technologies, etc., so they often have no direct competitors. However, the demand for them is significantly limited. If they exist, the prices of analogs are secondary when setting the initial price for one’s project.

Every sales manager can say that choosing an apartment has a more pronounced emotional component than a rational one.

No matter how the average price is set, the developer at the time of placing the average price is between two risks:

The initial average price of the project/building and the rate of price change during sales determine the total income of the project/building and form the sales plan.

And this is the right decision because the values of each apartment inside the building are different, so their prices should be different. But having determined the initial average price, you are unlikely to be able to start sales, as you are unlikely to want to apply one fee to all apartments.

Therefore, let’s move on to question 2 – initial price differentiation.

The concept of average means that in the general list of apartments in the building, there will be prices below average and above average. So which apartments should be made cheaper than the average, which ones are more expensive, and how should they relate to each other?

The developer must take several steps to differentiate initial prices successfully:

The developer can perform such actions in ordinary Excel. They take a certain amount of time – from several hours to several days, depending on the performer’s skills and the building’s parameters. As a result of the calculations, each apartment will receive its own, more or less unique price by applying the coefficients of each factor of differentiation to the initial average.

In the execution process, the developer will face the question – of what weights and coefficients to use because the final result depends on this. As a rule, developers solve this issue from their own experience.

In the process of researching approaches to initial calculating prices, we identified two most popular differentiation factors:

However, using only these two factors does not consider the popularity of small apartments (the smaller the apartment, the more customers can buy it for living or investment purposes) and the value of unique elements in apartments, such as terraces or private yards. Therefore, for more profound differentiation, it is better to add a few more factors, in particular, the price’s dependence on the area of the room, the presence of unique elements of the apartment, the convenience of planning, etc.

For more profound differentiation, it is better to add a few more factors, in particular, the price’s dependence on the area of the room, the presence of unique elements of the apartment, the convenience of planning.

As a result of applying coefficients, there will be a gap in prices between the most expensive and cheapest apartments. What should it be? The more expensive the real estate segment, the more extensive spread that can be involved.

In the process of researching approaches to the calculation of initial prices, we singled out the following algorithm of actions of the developer:

This whole process usually takes several days.

There are a few more definitions to keep in mind when setting initial prices:

So, does such a systematic approach protect the developer from error? It reduces its probability or scale but does not exclude it. Why? Because the issues that developers must resolve in calculating initial prices are often based on the executor’s experience and data on similar objects. It is not a fact that they will be relevant to the situation or project.

Considering the above definitions, the probability of making a mistake when setting initial prices is higher than the probability of setting them perfectly.

To assess the correctness of the established initial prices, we will determine what price requirements apply throughout the project:

1. Maximization of the total level of income.

2. Ensuring sales rates are close to plan. That is, developers should sell the apartments neither slower nor faster than the sales plan (therefore, to begin with, you need to make sure that there was such a plan).

3. Avoiding assortment disproportion – rapid sell-out of certain types of apartments, floors, or apartments with the same characteristics, with relatively larger remainders of other apartments.

As you can see, none of the above requirements apply to the initial prices. Why? Because the prices of one moment (the start of sales) affect the overall result much less than price management during the rest of the project implementation period.

Although, there are specific guidelines for initial prices that, along with frequent re-evaluations, will help meet all three requirements for overall price management. They are as follows:

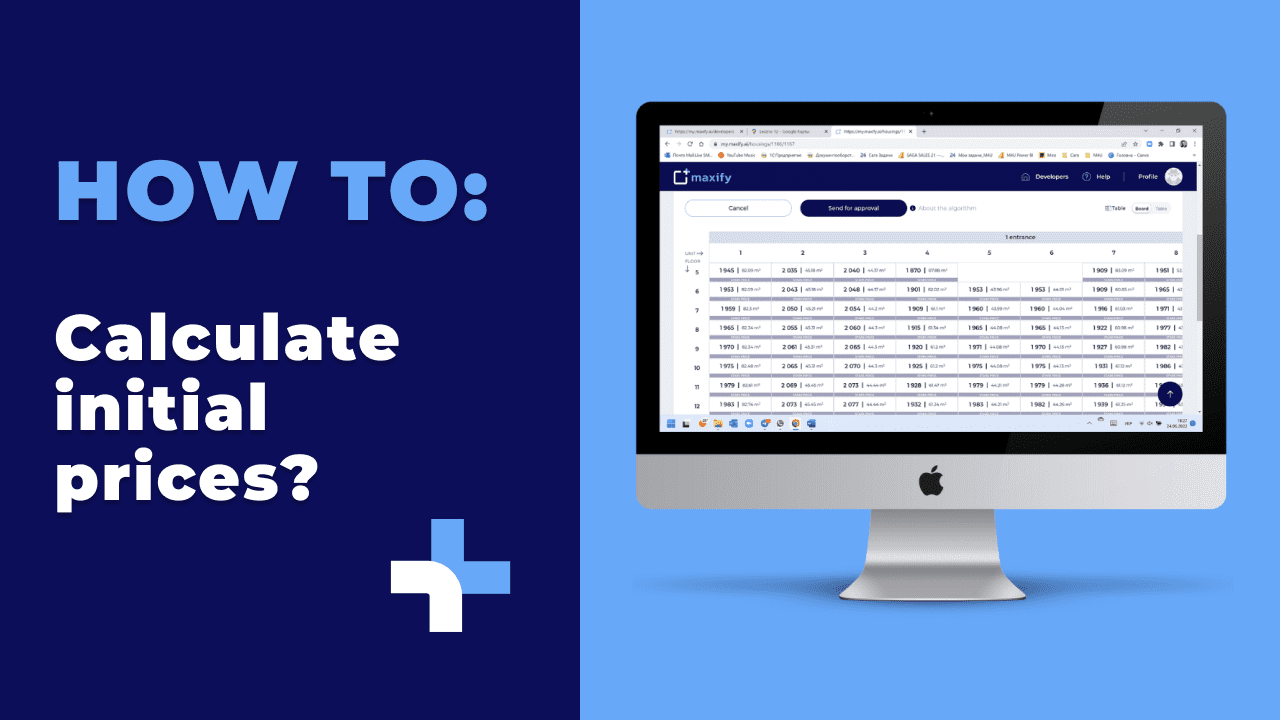

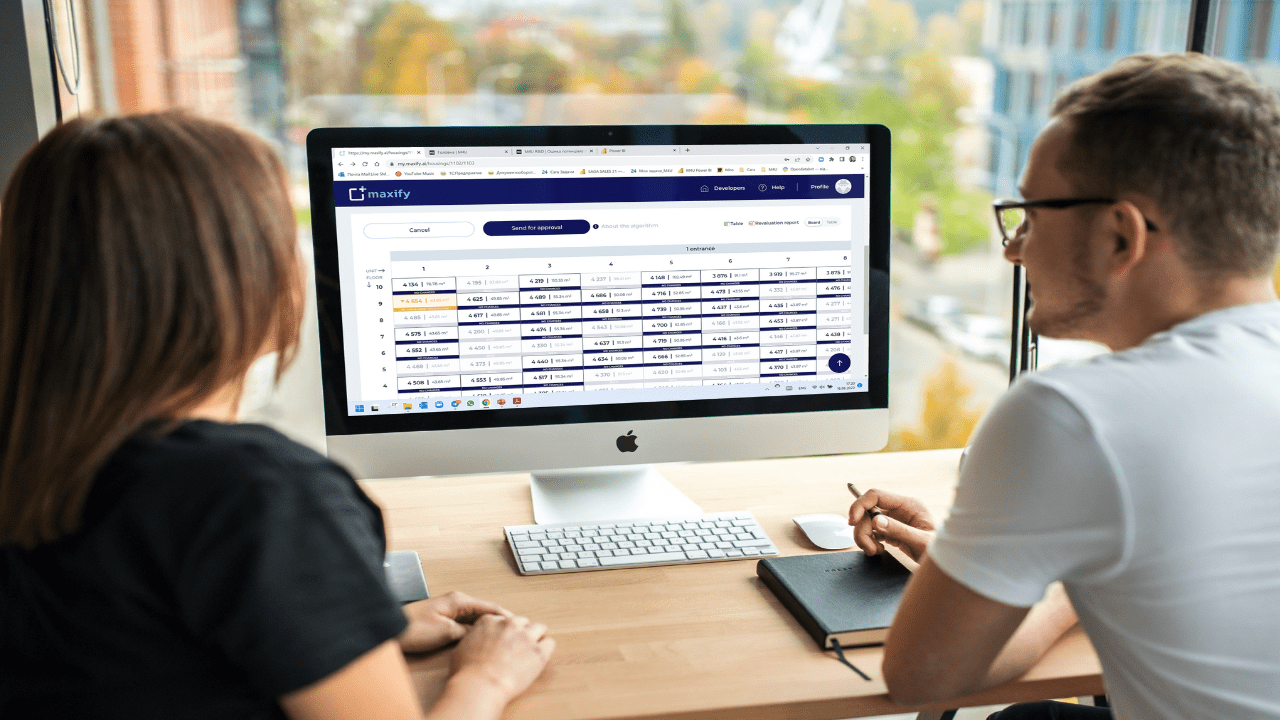

How we set initial prices in MAXIFY:

Apartment area

The floor on which the apartment is located

Specific characteristics estimated by the developer

The comfort of the planning decision, as assessed by the developer

The presence of unique elements in the apartment, such as terraces or private yards

Distribution of the apartment on several floors

The marking and grouping process can take several hours, and the calculation process – takes up to 1 minute.

So, with MAXIFY, developers will simplify the differentiating initial prices. But the main thing developers will get from MAXIFY is the possibility of prompt customer reaction to initial prices and their changes under the influence of demand.