In the second quarter of 2024, the Polish residential real estate market experienced significant changes. The market began to slow down after a strong start to the year with a record number of new projects. The number of new apartments introduced to the market decreased by over 20% compared to the first quarter. This decline was driven by a decrease in demand, prompting developers to reduce new supply.

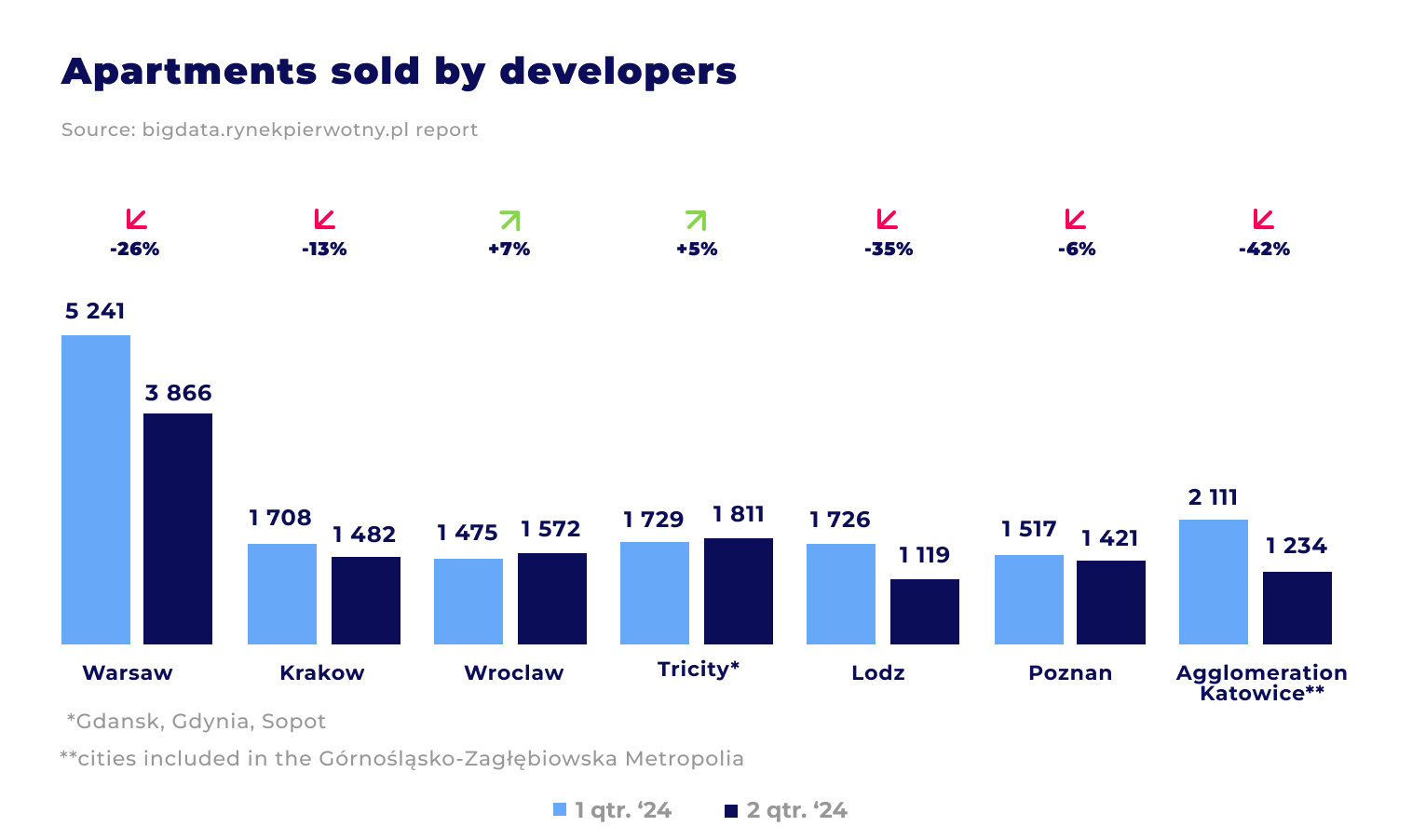

Sales of new apartments also declined: approximately 12,500 flats were sold in seven of Poland’s largest metropolitan areas (Warsaw, Krakow, Wrocław, Tricity, Łódź, Poznań, Gornośląska-Zaglembowska Metropolis), representing a 19% decrease compared to the first quarter. The most substantial drops in sales were recorded in the Gornośląska-Zaglembów Metropolis (42%), Łódź (35%), and Warsaw (26%).

Housing prices continued to rise. Łódź experienced the most significant growth, with average prices per square meter increasing by 8% since the beginning of the year. In other major cities, prices rose between 2% and 7%. To maintain price stability, developers introduced more apartments in the middle-price segment.

One of the primary challenges facing the market is the high cost of loans. Current mortgage rates remain elevated, making homeownership difficult for many potential buyers. The postponement of the “Mieszkanie na start” program, designed to provide affordable loans for first-time homebuyers, has introduced further uncertainty. This program, intended to replace “Bezpieczny kredyt 2%”, has been delayed without a confirmed implementation date.

High mortgage interest rates are deterring many potential buyers from purchasing homes. As a result, developers are offering various promotions and discounts to attract customers. For example, some developers are offering deferred payment plans, allowing buyers to pay up to 80-90% of the housing cost upon completion.

Despite current challenges, the outlook for the Polish residential real estate market remains positive. There is hope for price stabilization and a gradual decline in interest rates, which could stimulate demand recovery. Additionally, investors continue to view real estate as a profitable investment, especially in the context of high inflation.

The Polish residential real estate market is currently undergoing a period of adjustment to new conditions. Decreased demand and high interest rates present challenges but also create opportunities for new strategies and investments. Developers must adopt more flexible and creative approaches to attract buyers and maintain market stability.

Stay tuned for further developments, as the market continues to evolve.